tax per mile reddit

19 cents per mile driven for medical or moving purposes. No you dont get paid that much per mile driven but you can deduct that much on top of your standard deduction I believe.

Uber Drivers Often Unaware Of Tax Obligations Cbc News

545 cent per mile is the IRS rate for 2018.

. Other forms you use will attach to your 1040 when you submit it to the IRS. 2 Car tax to be ring-fenced and actually spent on improving our roads - not just for drivers. Depending on the type of vehicle you own your annual costs to drive 15000 miles per year could vary substantially from a high of 10839 for a pickup truck to a low of 7114 for a small sedan AAA reports.

For example if you drove your vehicle 1000 miles for IRS-approved business purposes in 2021 multiply 1000 miles x 056 per mile. Either through increasing fuel duty or using mileage readings taken during an MOT. American drivers could soon trade paying taxes on gas at the pump for owing the government annual per-mile user fees under a new pilot program recently passed by the Senate in Joe Biden s 12.

206 of the 611 vehicles in Oregon. To use the standard mileage rate for a car you own you need to choose this method for the first year you use the car for business. The rate for business travel expenses has dropped from 575 cents per mile in the 2020 tax year to 56 cents per mile for 2021.

Standard Mileage Rate for Business. Owning and operating a vehicle isnt cheap the average cost to keep rolling is 9282 per year according to a 2019 study by AAA. Youre not going to get audited.

You can push it. 1 A pay-per-mile road tax rewarding people for driving less. Youll be able to deduct 560.

According to the GAO that would represent a. You can easily claim 1miledollar earned easily. The estimated cost per mile of gas is 184 cents down 40 from 298 cents per mile in 1993 all amounts in.

A driving tax proposed by President Joe Biden would cost Americans 8 cents per mile. The mileage tax deduction rules generally allow you to claim 056 per mile in 2021 if you are self-employed. This is the main tax form that everyone needs to fill out.

54 cents per mile for business miles driven. With the rise of electric vehicles cars with better miles per gallon and decreased personal travel during the COVID-19 pandemic revenue from the gas tax has declined. In 2019 Oregon lawmakers expanded their VMT program and prohibited cars that get fewer than 20 miles per gallon from participating in the program moving forward.

An interesting thing is that the all-new Hyundai Ioniq 5 SE RWD 774 kWh. Deductible business miles include driving to work-related functions meeting clients and going to job sites. And 10000 in expenses reduces taxes by 2730.

14 cents per mile driven in service of charitable organizations. Tax filers use Schedule C to determine their total profit and losses for the year. If you drive your car for your deliveries every mile is worth 56 cents off your taxable income the standard mileage rate for the 2021 tax year it bumps up to 585 per mile in 2022.

Figure out how many dollars you make per mile you drive and then just do the math for your total earnings. Ryan Stubbs Good morning. Gavin Newsom a Democrat signed legislation Friday expanding a pilot program that charges drivers a fee based on the number of miles they drive instead of a gasoline tax.

Most Uber and Lyft drivers will need to use at least the following tax forms. However after a couple months she decided to go a different direction and left that job. Oct 1 2021 0528 PM EDT.

For a pay-per-mile tax to generate that kind of revenue drivers would need to pay an average of 22 cents per mile. President Joe Biden has called for a driving tax that is estimated to be 8 cents per mile. The infrastructure bill includes 125 million to fund pilot programs to test a national vehicle miles traveled fee.

A spreadsheet is completely overkill. Thats 12 for income tax and 1530 in self-employment tax. Due to taxes she only received about 6800 of that money.

Tesla Model 3 Long Range AWD at 146mile. The standard mileage rates for the use of a car also vans pickups or panel trucks are. Due to not fulfilling her contract she had to pay back the full 10k to the company even though she didnt actually receive that much.

Oregon and Utah launched similar pilot programs in 2015 and 2020 respectively that yielded mixed results. The 545 cent number is very generous since most uber drivers have 20k cars and if they drive 100k miles in a year there is no way vehicle expenses are 545k. The timing of a vote on a 12 trillion infrastructure package divided House Democrats this week.

More efficient cars end up being nailed worse. My wife started a new job and received a 10000 starting bonus. Nissan LEAF e S at 114mile.

The state gasoline tax is only 019 thats only represents 4-6 of the cost of a gallon of gasoline. Few people volunteered for the programs initially because of privacy. If your car gets 24 mpg now youd be paying 120 in tax based on mileage vs the 060 if paying per gallon.

While Congress and the states kick around proposals to increase funding for infrastructure Robert Atkinson an opinion writer for The Hill has backed the idea of charging big rigs taxes based on the number of miles they driveCertainly not a new idea pilot programs for a per mile tax have been ongoing in several states although. 3 Practical advice for drivers from the Government around lowering carbon emissions. You may also be able to claim a tax deduction for mileage in a few other specific circumstances including if youre an armed forces reservist qualified performance artist or traveling for charity work or medical reasons.

005 per mile would end up as a massive increase in the taxes you are paying. Congress has refused to raise the Federal Fuel Tax since 1993 1. This includes 10 million each year from 2022 to 2026.

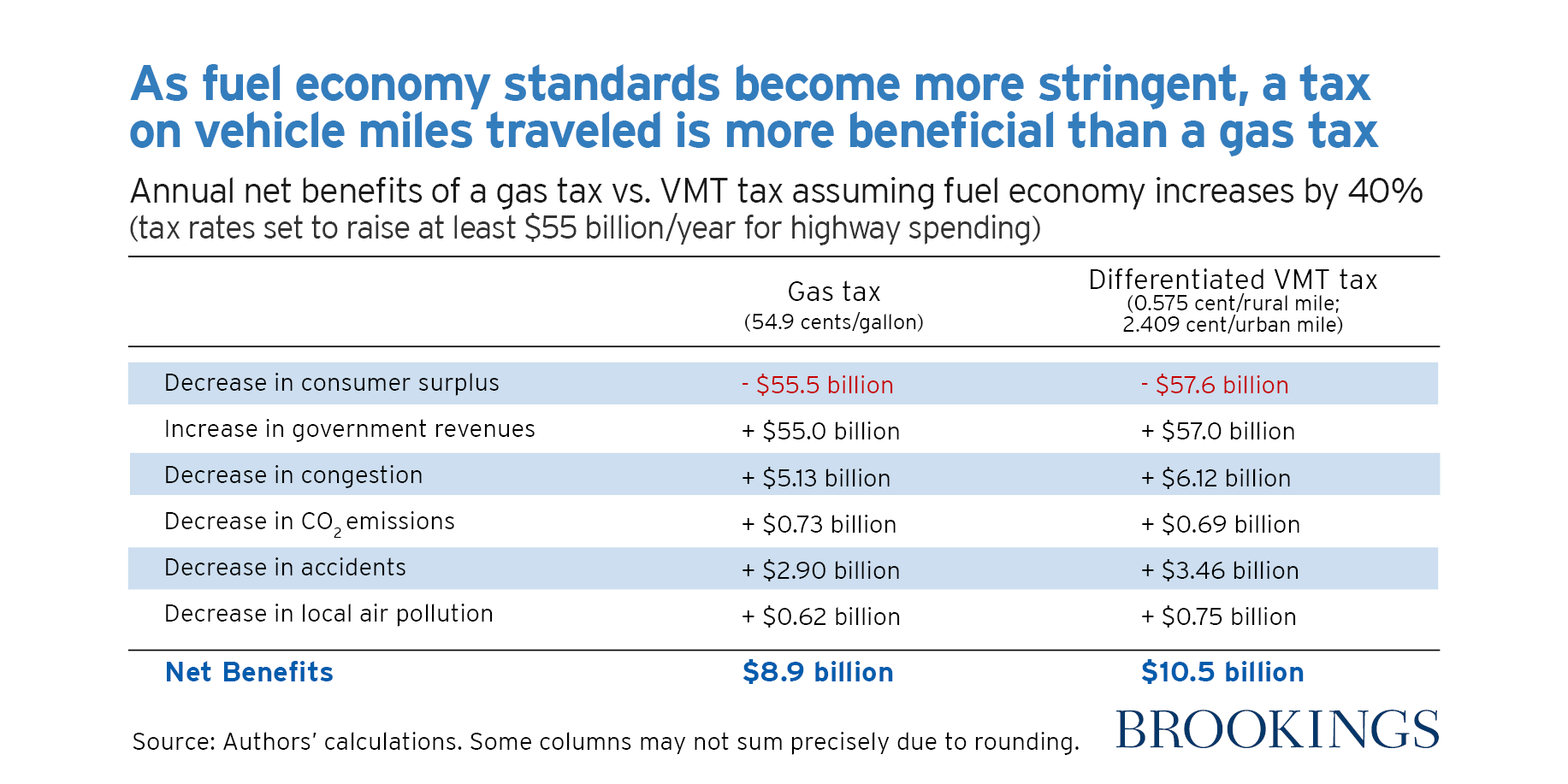

The Taxation Of Fuel Economy Tax Policy And The Economy Vol 25 No 1

Vehicle Miles Traveled Vmt Fees Study Texas A M Transportation Institute

Ditching The Gas Tax Switching To A Vehicle Miles Traveled Tax To Save The Highway Trust Fund

The Taxation Of Fuel Economy Tax Policy And The Economy Vol 25 No 1

Irs Increases Mileage Rate To 58 5 Cents Per Mile For 2022 Grossman St Amour Cpas Pllc

Pay Per Mile Tax How Would It Impact You R Ukpersonalfinance

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

The Taxation Of Fuel Economy Tax Policy And The Economy Vol 25 No 1

Ditching The Gas Tax Switching To A Vehicle Miles Traveled Tax To Save The Highway Trust Fund

How Can I Reduce My Taxable Income At The End Of The Year

Editorial Biden Brings Back Road Usage Tax Plan

The Taxation Of Fuel Economy Tax Policy And The Economy Vol 25 No 1

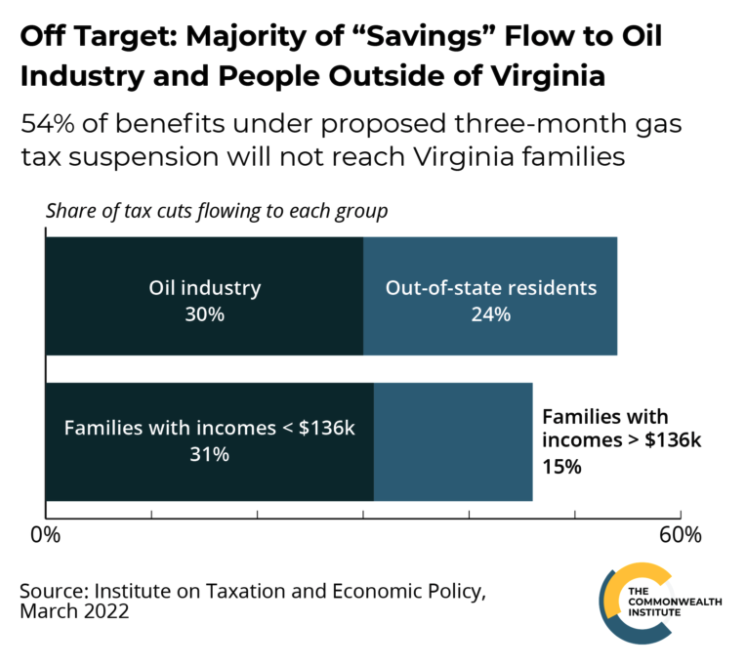

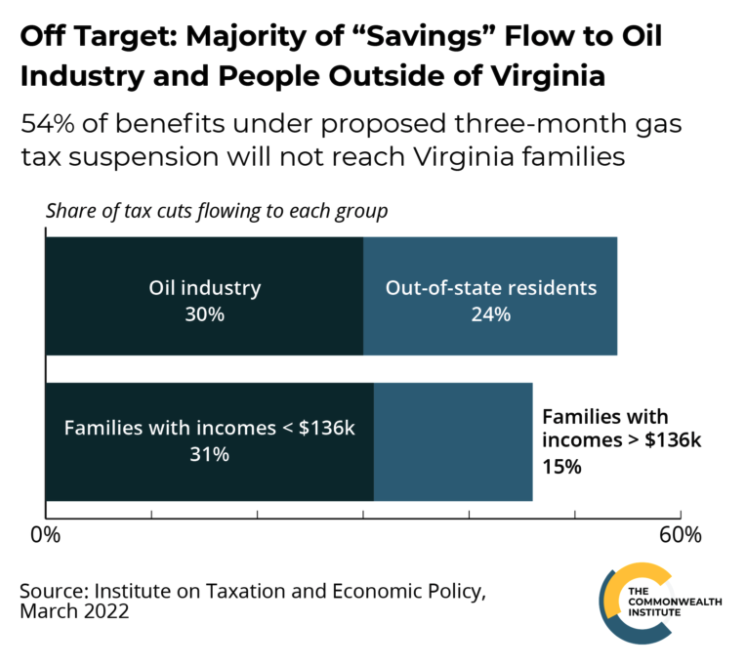

Roundup How A Gas Tax Suspension Actually Affects Virginians

California S Drivers Pay High Gas Taxes And Prices For Roads And Bridges In Poor Condition Daily News

Biden S New Vehicle Mileage Tax Program Will Charge Per Mile Driven Possibly Affecting Pizza Delivery Drivers Significantly R Talesfromthepizzaguy

Uber Drivers Often Unaware Of Tax Obligations Cbc News

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Irs Increases Mileage Rate To 58 5 Cents Per Mile For 2022 Grossman St Amour Cpas Pllc